Mutual Funds

8/23/2022

Mutual funds are investment vehicles that pool investors’ monies to create a large pool of assets that can be invested in stocks, bonds, or other securities. When you invest in a mutual fund, you buy units and become a shareholder of the fund. Mutual funds are also described as a professionally managed Collective Investment Scheme. Furthermore, investors in mutual funds own a pro-rata share of the overall portfolio.

Mutual funds are generally referred to as open-ended funds because they have no limit to the number of investors or volume of the units sold in the fund. The fund sells new units to investors and stands ready to buy back its old units. More so, the capitalisation of mutual funds is not fixed, and they can issue more shares depending on how much the investors want to invest in the fund. Unlike unit trusts, the investment manager of the mutual fund actively manages the portfolio, that is, buys some securities and sells others to exploit market inefficiencies.

The price of a mutual fund is determined by that fund's Net Asset Value (NAV). The NAV is the portfolio's market value, including capital appreciation and dividends minus the liabilities of the mutual fund divided by the number of shares owned by the mutual fund investors. Therefore, an increase in NAV implies a higher value for the fund investor.

There are various types of mutual funds, each with its unique nature and investment strategy. Some mutual funds have portfolios comprising only stocks, bonds, money market securities or a mixture of fixed income securities and equities. Mutual funds have two price quotes. The offer price is the current price the fund managers will sell a unit of the fund to subscribers, while the bid price is the price they will buy a unit of the fund from shareholders. The offer and bid prices change just as share prices do.

How Did Mutual Funds Evolve?

Mutual funds date back to the 1800s, when English and Scottish investment trusts sold shares to investors. Funds arrived in the United States (U.S) in 1924. They grew in assets until the late 1920s, when the Great Depression derailed the financial markets and the economy. Stock prices plunged, and so did mutual funds that held stocks. Although bruised, mutual funds overcame this economic mishap like other investment instruments.

Following the Great Depression, regulators established stringent rules and oversight of the fund industry. In most cases, the approval of the country's Securities and Exchange Commission (SEC) is required before issuing or selling the shares of any fund to the public.

Over time, this legislation has been strengthened by requiring funds to disclose cost, risk and other information in a uniform format through a legal document called a prospectus.

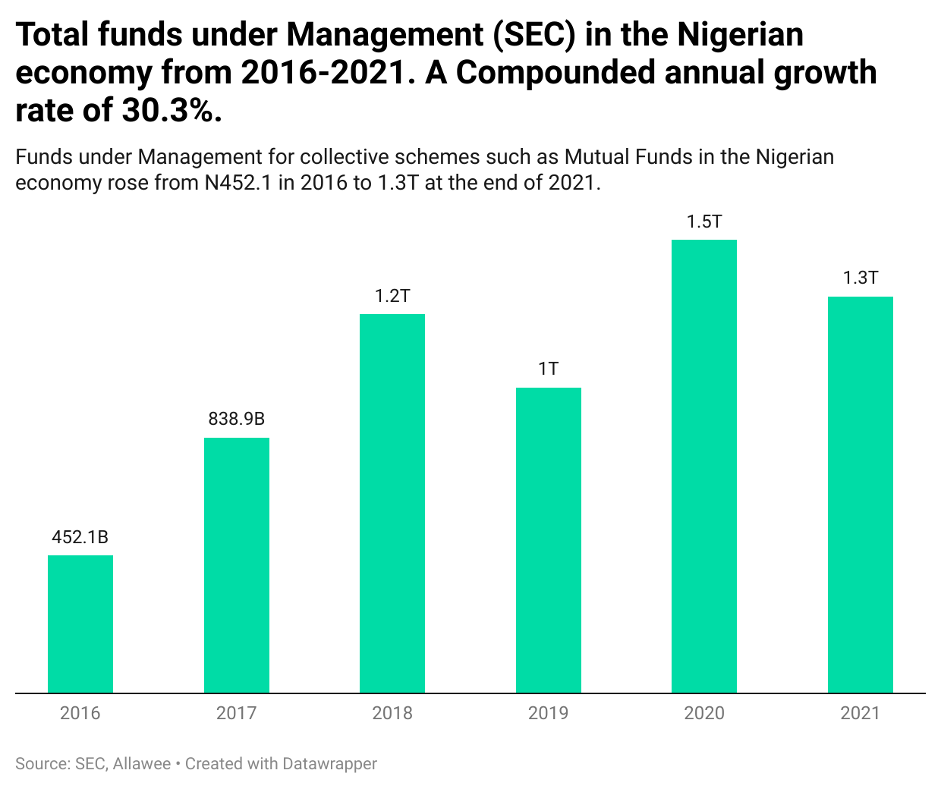

In Nigeria, there have been an increasing number of mutual funds. Their operations in Nigeria came to the limelight for the first time in the early 1990s as a result of the rapid growth in the financial sector induced by the deregulation policy of the mid-1980s. Mutual funds emerged as part of the innovations in the financial markets that followed the policy of deregulation. ARM and IBTC can be said to be the pioneers in the mutual

Mutual funds in Nigeria became more prominent on the back of the 2005 banking consolidation, although they can say they are in their mid-stage compared to other mutual funds in the advanced world.